Autonomous Driving: How to Judge Strategic Partnerships?

Nabu Xavier

July 19, 2019

Our competitors no longer just make cars. Companies like Google, Apple and even Facebook are what I think about at night.

– Akio Toyoda

While the automotive industry is no stranger to partnerships between rivals, a recent tide of partnerships to develop autonomous driving has been raising interest and a lot of questions regarding the fruitfulness of such “tie-ups”. Major players like Daimler and BMW, VW and Ford, Renault and Fiat have already formed or are in the process of forming strategic partnerships to develop technologies in the field of “Autonomous Driving”. All these proposed ventures will shape the face of mobility in the future. It is therefore important for the parties in it to ensure that they are forming the right alliances. But how to go about finding out the secret strength that a prospective partner possesses? With LexisNexis® PatentSight®. We believe and can demonstrate that patent analysis, using our award winning software and scientifically validated metrics, is an excellent method to scout for and investigate proposed strategic partnerships.

How to judge the strength of a strategic partnership?

To assess the strength of technology that a company possesses, the most comprehensive and publicly available information that one has is patent data. And, our scientifically-developed metric, Patent Asset Index, is a highly accurate indicator of strength or quality of a company’s patent portfolio. Using this metric and our powerful award-winning software, we looked at the patents involved in these probable partnerships and owned by the individual players involved. While each have their own strengths, it is more interesting to see how these strengths come together in a partnership to form a formidable venture that can weather the turbulent future that is predicted for the mobility industry, where disruptive technologies are tearing down the norms on a daily basis.

Taking a look at a select few main players in the field

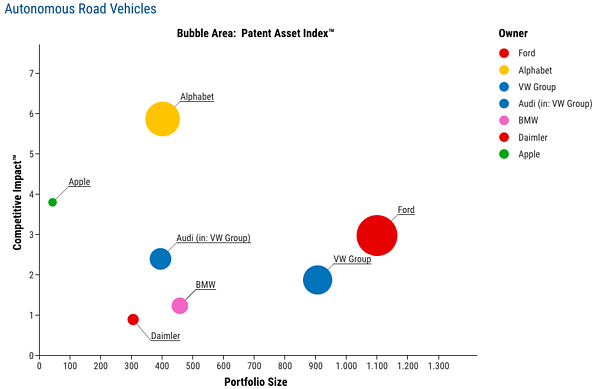

To begin with, we looked at a selection, of traditional and a couple of new players, who are developing technologies in the field of “autonomous driving”, this allowed us to get an overview of the technology landscape. The image below depicts their portfolio strengths in an easy to compare format; the larger the bubble, the stronger the portfolio. The relative position of bubbles with respect to Competitive Impact (y-axis) shows the average quality of the portfolio.

Going by the size of the bubbles, which depicts the overall strength of these companies’ portfolios, it can be summarized that while Ford has the most number of patents in the field, Alphabet, basically a technology company with no background in producing cars, owns a portfolio less than half the size of Ford’s but equally strong in terms of overall quality. When you look at BMW and Daimler’s portfolios, it seems that although these reported partners have smaller sized portfolios, there could be other key factors that are not visible in this picture that might have motivated them to form an alliance.

Top 20 developers of the technology

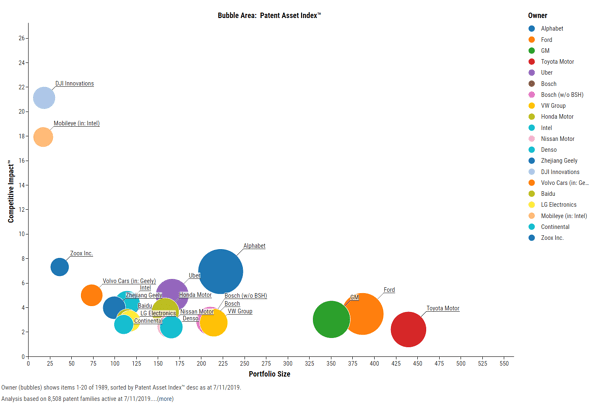

Next we took a look at the top 20 players (according to their portfolio strength) in the field to generate a wider view of the technology space and to consider new players who may not have large portfolios.

This search brought up a slew of companies who, until recently did not exist in the same playing field as the “giants”. And, if you take a closer look, some surprising names like LG, Uber, Intel, DJI Innovations and Zoox Inc. stand out since these are not companies that one would expect to come across as performing research in the automotive industry. Now, whether these companies are developing similar technologies for other equipment, like accessories or are looking to position themselves as suppliers of technology, needs further investigation into their respective portfolios.

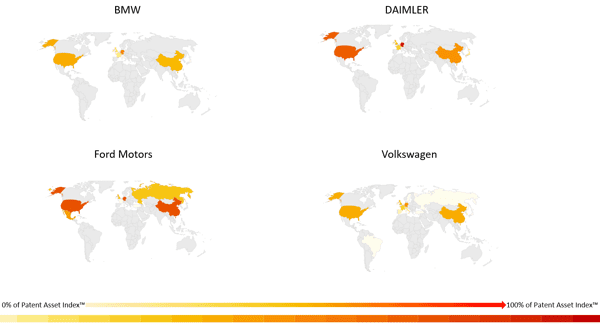

Proposed partnership – A look at global heat maps of technology protection

As for the proposed partnerships, we looked at a few of the companies and their individual portfolio, as seen below, to see the global distribution of their portfolio strength. This heat map shows where the companies have chosen to protect their technologies, thus giving us an idea about how the future partnership can impact their global strategy.

Learn more about PatentSight and the Patent Asset Index.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.

Access articles from our e-mobility series:

- e-Mobility – Watch Out Traditional OEM’s!

- e-Mobility – Why is Knowing the Legal Status of Patents Important?

- e-Mobility Technology – Who Owns the Strongest Patent Portfolio?

- e-Mobility Technology – How to Predict the Portfolio of Your Competition

- e-Mobility Technology – Who’s Making It vs. Who’s Buying It?

- e-Mobility Technology – a Final Look at the Top Patent Owners