e-Mobility Technology – How to Predict the Portfolio of Your Competition

Sarbani Chattopadhyah

October 20, 2019

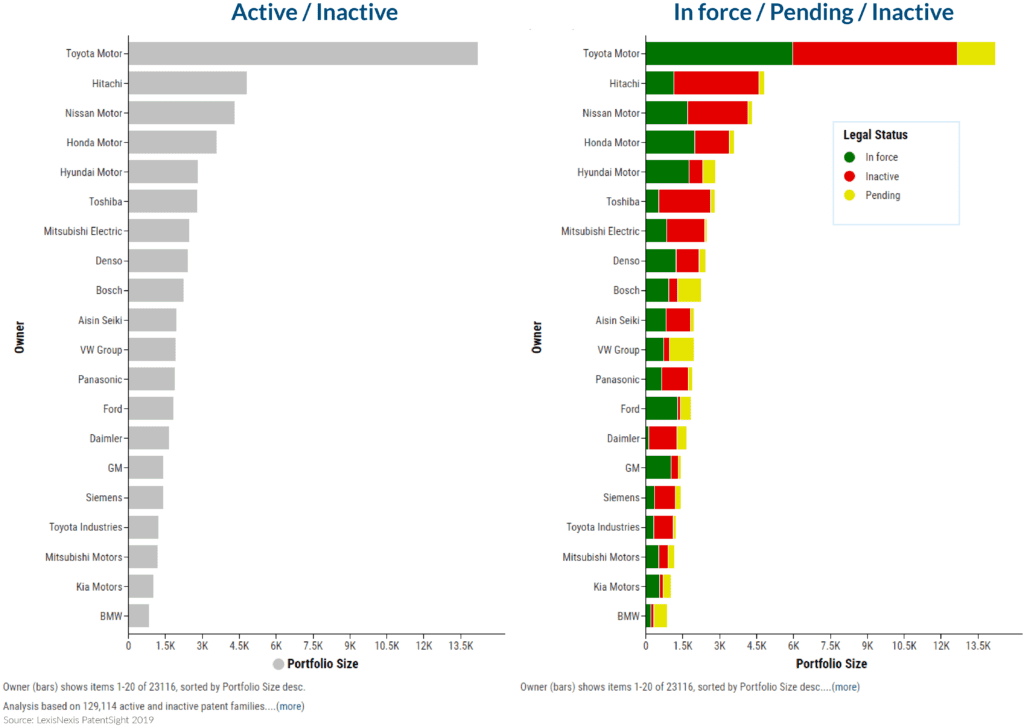

Having seen in all of our previous blog posts on e-mobility technology that more information is always better than little information, now we are using LexisNexis® PatentSight® to take a look at the top 20 patent owners in e-mobility based on the distribution of ‘in force’ and ‘pending’ patents within their ‘active’ portfolio in e-Mobility technologies. Our previous post in this series discussed how these players ranked, in terms of their ‘active’ patent portfolio in this technology. This week, we emphasize the importance of accurate legal status information, by differentiating active patents into ‘in force’ and ‘pending’ to predict the portfolio of your competition.

What is the difference between ‘in force’ and ‘pending’ patents?

Our data team uses these terms to separate patents that are currently granted and active (in at least one authority) from those patents that are currently filed in at least one patent office but have not yet been granted. The former category of patents is referred to as ‘in force’ patents and are more valuable to an organization as they can be legally enforced, whereas the latter are called ‘pending’ patents and have limited or no legal power. This differentiation, gives us a clear idea if a firm has been filing patents for some time and own a portfolio of granted patents in e-mobility technologies, and helps us predict the portfolio of your competition. It could be that firms with a large number of pending patents in their portfolio are more likely to have stepped up their patent filings fairly recently. In any case, it is safe to assume that a company with a larger portfolio of ‘in force’ patents is better positioned, in a current competitive context, as compared to a company with a majority of its patents pending approval by the patent authority.

Top 20 patent owners in e-mobility technology according to ‘in force’ patents

Looking at the picture below, if you had been following our previous posts in this series, you may recognize the graph on the left. This graph shows us the importance of knowing the legal status of patents, as we discussed how this information affects our view of a firm’s portfolio. Whereas the graph on the right side shows the same top 20 patent owners, with additional differentiation information about the legal status of their respective portfolios. This information has been included in this week’s analysis, to get a finer look at their patents’ legal status and to predict the portfolio of your competition.

Toyota Motor, who leads the race in overall portfolio size of patents protecting e-mobility technology, maintains its position as the leader when considering active patents in the portfolio as well – with about 6000 patents that are currently active and in-force, roughly 40% of their entire portfolio of patents in this technology are classified as ‘in force’. Toyota’s portfolio also includes around 1500 patents (~10% of total portfolio) that are filed for, but pending decision at the respective patent offices where they were filed. Next in line with the highest number of ‘In force’ patents in their portfolio is Honda motors. Honda’s portfolio in this technology contains around 2000 ‘In force’ patents, which makes up more than 50% of their e-mobility technology portfolio. They have also filed another 200 or so patents awaiting decision at the respective patent offices. Closely following Honda, in number of ‘in force’ patents owned, are Hyundai and Nissan, who each own close to 1800 patents protecting e-mobility technologies. Whereas in the case of Hyundai this makes up more than 60% of the portfolio in e-Mobility, in Nissan’s case this is only 40% as their portfolio also includes more than 50% inactive patents. A detailed report of all the patents and their statuses which we exported from our software was used to calculate these percentages.

How you benefit from our detailed legal status information

This additional information regarding pending applications provides a clearer perspective about portfolio of your competition and the companies’ current state of innovation in the field and a future outlook of their portfolios within this technology class. From the point of view of an e-mobility developer, this information is extremely beneficial to orient your patenting strategy towards tackling the competition. Since you now have information about probable future outlook of your competitor’s portfolio and get a look at the status of patents that they have already filed in a specific technology. Once you are satisfied with the results of your analysis, you don’t need to print it out or copy paste it elsewhere since it can easily be exported to an Excel file or even saved as a Workbook and shared with your team on our award-winning Business Intelligence software.

Armed with this level of deep insight, your organization would be making decisions from a position of power based on knowledge. Rather than make assumptions based on unreliable sources of information that have far less credibility you can now base your decisions on scientifically validated measures and accurate patent data. Thus, your firm can make proactive decisions to address the patent protection strategies of your competition.

Access all of the articles in our e-mobility series:

- e-Mobility – Watch Out Traditional OEM’s!

- e-Mobility – Why is Knowing the Legal Status of Patents Important?

- e-Mobility Technology – Who Owns the Strongest Patent Portfolio?

- e-Mobility Technology – Who’s Making It vs. Who’s Buying It?

- e-Mobility Technology – a Final Look at the Top Patent Owners

Learn more about PatentSight.

About the Author: Dr. Sarbani Chattopadhyay

As a consultant, Sarbani assists clients in using PatentSight in the most optimal way, so that they get insights about patents, about their own portfolio, and portfolios of their competitors, and technologies they are working with, as well as which other technologies are being influenced by their inventions.

New Report

Who Is Leading the VVC Patent Race?

The VVC codec patent landscape is complex, with multiple patent pools and varying rules across jurisdictions. This report provides strategic insights into competitor portfolios, helping companies make informed IP decisions and stay competitive in the high-resolution video market.