Objectively Evaluate Innovation

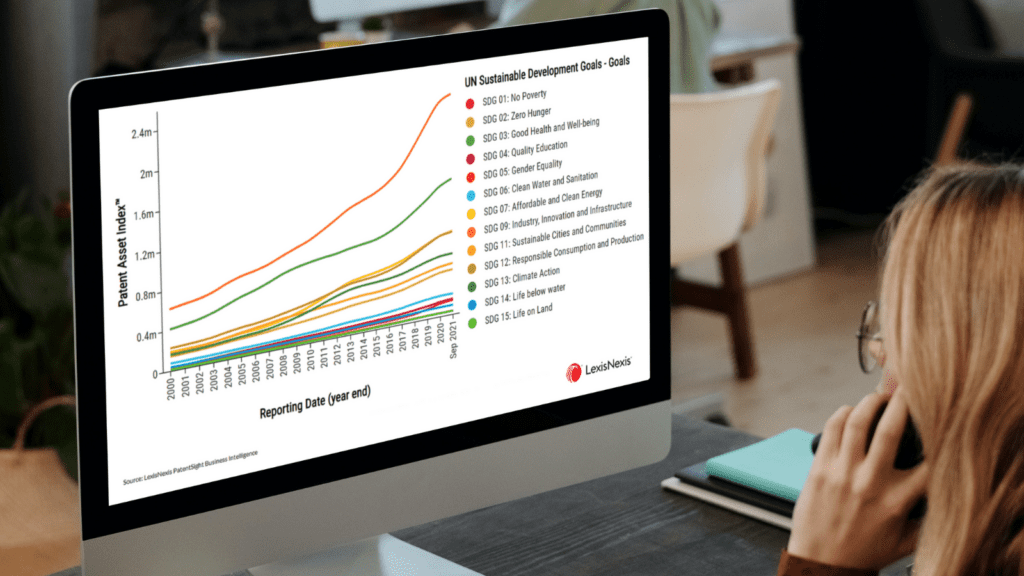

Use the scientifically-developed Patent Asset Index to measure the global technological strength and influence of patents.

What is the Patent Asset Index?

The Patent Asset Index is a scientifically developed objective measure used to evaluate innovation in LexisNexis® PatentSight+®.

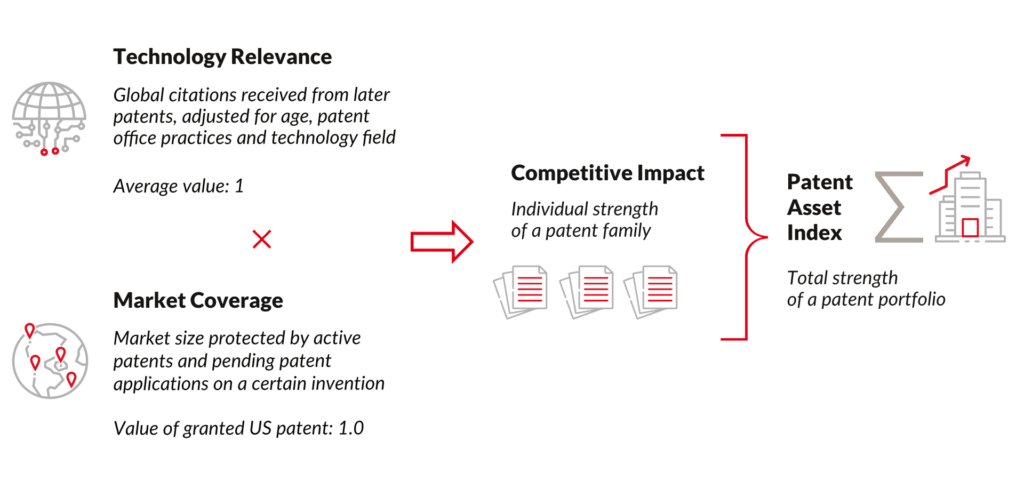

Our research has shown that the value of a patent depends mainly on two factors: other patents being filed that build on the technology protected by the patent in question and the geographical scope of patent protection. Simply put, a patent is considered more impactful when it leads to further inventions and is protected in multiple authorities. Patent Asset Index is measured based on two separate indicators, Technology Relevance and Market Coverage.

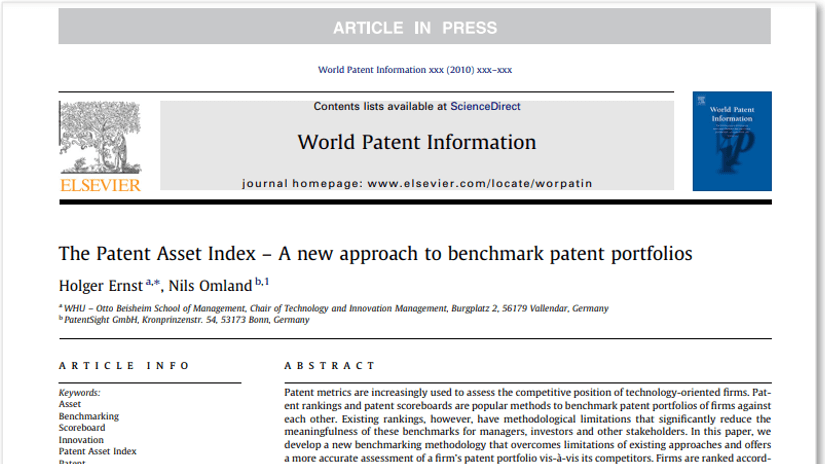

Scientific validation of the Patent Asset Index methodology

The Patent Asset Index methodology is based on many years of scientific research and validation studies. Published in an academic journal for review (Ernst and Omland, 2011), patents with high Competitive Impacts were discovered to have a higher commercial value when compared to a randomly chosen control group of patents.

“The Patent Asset Index provides an accurate overall view of the impact and efficiency of an enterprise’s investment in innovation.

Chief Technology Officer

Dow Chemicals

Early identification of disruptive players with advanced patent analytics

What if it was possible to spot trends early on to better prepare for market shifts? The Patent Asset Index allows you to identify leading or even disruptive technologies irrespective of whether you are analyzing a mature technology field dominated by multinationals or an emerging space.

Patent Asset Index FAQ

What is the use of the Patent Asset Index?

The Patent Asset Index represents a measure of the innovative strength of an enterprise or an entire technology field. It is calculated at the level of a patent portfolio as the sum of the Competitive Impact scores of the individual patent families contained in this portfolio.

Depending on the question to be addressed, the Patent Asset Index can be calculated for a company as a whole, or just for patents belonging to specific business areas or technology fields. In this case, it shows the strength of the company in those particular domains only.

What are the advantages of the Patent Asset Index methodology?

The methodology is transparent and widely published. In addition, it is scientifically validated and approved in the corporate world. Our indicators and underlying data are broadly accepted and applied in the industry by many blue-chip companies across all sectors. They are even used in Investor Communication by Fortune & DAX and other companies (Dow, BASF, Daimler, Evonik, and others).

The Patent Asset Index has been unchanged since its inception in 2008, standing for validity and stability of the approach.

What is the coverage of the PatentSight+ database?

The patent databases INPADOC and DOCDB provided by the European Patent Office (EPO) are the central patent data sources for the PatentSight+ database. Furthermore, we add legal status information from national offices (US and JP) to the data stream as well as subsidiary information from corporate structure databases. In addition, all patent offices around the world provide their patent data with the EPO, so we cover all relevant patent data worldwide. The PatentSight+ database currently covers patent data from more than 80 patent authorities.

Since PatentSight+ is part of LexisNexis®, our database also contains IP DataDirect (IPDD). IPDD from LexisNexis provides worldwide patent information in bulk. The entire IPDD content with improved bibliographic and legal status information will be integrated into the PatentSight+ database by the end of 2021.

Which patent family definition is used?

PatentSight+ uses the simple family concept of the European Patent Office (EPO) also known as the S-Fam or Espacenet family. This family concept requires that all family members are based on an identical set of priority documents. This ensures that all the family members cover the same invention. This is also an advantage over the INPADOC family: patent documents in an INPADOC family can have only partially overlapping priorities, thus putting documents together in a chain-like manner that in the end have only little in common. These families might become so broad in the different types of inventions that they cover, that they are not helpful for technology benchmarking purposes anymore.

Additional information regarding the simple family definition is available on the website of the EPO.

Why is the legal status of a patent family important and how is it determined?

To evaluate the current strength of a patent portfolio or identify the relevant IP of a company only active patent families should be taken into account. The inactive ones are mostly not of interest, though they can also be included. The main data source for the legal event information is the INPADOC database, which is updated on a weekly basis.

We carefully interpret the various event codes to determine the legal status of the documents in a family at each given point in time. In the next step, we aggregate the legal status information per document on the patent family level using sophisticated heuristics.

The heuristics applied for the interpretation have been developed and implemented in close cooperation with well-known legal status experts from industry and patent offices. Currently, further national registers are being evaluated to be included as primary sources of legal status information in the future.

How does PatentSight+ identify the current owner of patents?

For the correct evaluation of patent portfolios, it is crucial to know the current owner of a patent family, which can be quite difficult. There are many different applicant names a company uses to file a patent, which can include misspelling and translation errors. In addition, tracking patent ownership over time is intricate: companies merge, change their names, sell and acquire business units, sell and buy patents, etc. Identifying the current owner of all relevant patents requires substantial effort, which is not possible by computer algorithms alone. Specific expert research is required to accurately track patent ownership over time for each individual company.

PatentSight+ identifies patent ownership based on extensive research on corporate structure, M&A, spin-offs, company name changes, and patent transactions amongst others. In doing so, PatentSight+ contains company structures including all domestic and foreign subsidiaries, joint ventures and group companies. The harmonized ultimate owner also includes former names of the company itself or any of its subsidiaries. The assumption is that usually, the parent company (ultimate owner) has control over the patents of a subsidiary or an affiliate company.

Case Studies

Unlock the true value of your portfolio

Learn how to profit from sound patent analysis.

We would love to get to know you and show you some invaluable insights into the IP landscape:

- Let’s have a conversation about your current priorities in IP analytics.

- Get an external view of your portfolio.

- Learn how others see you and survey other market players from a new perspective.

Submit the form, and we’ll be in touch.

Related Resources

Patents in Decarbonization: Toyota Leads in Number, Samsung Ranks First in Total Strength (Patent Asset Index)

The world is increasingly moving toward decarbonization. This ranking looks at some of the top manufacturers of such technology.

New Patent Analytics Report: “Driving Toward Tomorrow: A Deep Dive Into Autonomous Vehicle Innovation” Reveals Key Players and Latest Developments

The report “Driving Toward Tomorrow: A Deep Dive Into Autonomous Vehicle Innovation“ dives into the world of autonomous driving technology.

Analysis Reveals Companies With Strongest Patents Related to COVID-19 Vaccines

Here are the findings of an analysis of COVID-19 vaccine-related patents held by pharmaceutical and biotech companies worldwide.

How Sanofi Strengthened its Position in Pharmaceuticals Through Strategic M&A Deals

A look at how M&A deals have improved patent portfolio size, quality pharmaceuticals and innovative medicine for Sanofi.

PatentSight+ Solutions

In today’s rapidly evolving landscape, IP professionals face the daunting challenge of navigating a complex maze of intellectual property on top of increasing cost pressures. These challenges demand clear, actionable insights to make strategic decisions with confidence.

Competitive intelligence & benchmarking

Portfolio management & optimization

Disruptive technology scouting

R&D and innovation

Sustainable innovation analytics

Risk assessment

Licensing & SEPs