China’s Energy Industry Explosion: A Risk or Possible Reward for Global Engineering Players?

China’s power consumption is predicted to skyrocket, with the nation set to use a third of the world’s electricity by 2025 – more than the US, OECD and Europe combined, according to the International Energy Agency.

Further, the BP Statistical Review of World Energy 2022 reports China’s electricity is currently being generated using coal (63%), hydroelectric (15%), renewables (14%), nuclear (5%), natural gas (3%) and others. The World Bank warns that the nation’s current energy mix, which is heavily reliant on coal, won’t enable it to achieve its carbon-neutral goals by 2060.

Meeting this surge in demand, coupled with the need to transition to cleaner energy sources, means that China is increasingly turning to innovative technology solutions to address the country’s energy needs. This has significant implications for international Engineering companies developing electrical energy generation technology and poses new risks, or possible opportunities, for their business.

Patents reveal investments in Chinese electrical energy generation technologies growing steadily

Developing products and applying technologies that are based on inventions require having a legal right to do so. So, inventions are protected by patents as soon as possible—often months or even years ahead of a product being ready for market—to guard a company’s technological leadership and commercial interest. Thus, in addition to being a valuable source of information about both the invention and the inventor, patent documents are also forward-looking instruments that can help predict trends in an industry, early on.

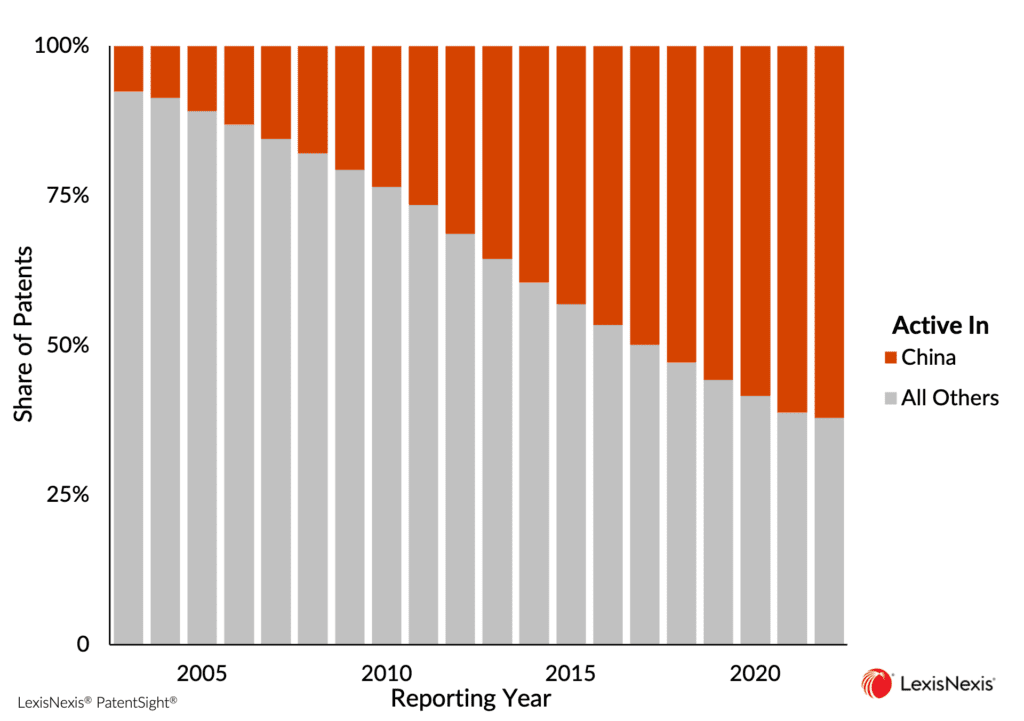

To safeguard their business interests in the rising Chinese energy market, both domestic and international Engineering companies in the energy sector must protect their inventions and file for patents in China. As a result, the number of active patents in this field in China has been increasing over time. Figure 1 below clearly depicts how, back in 2003, only a fraction of the Engineering companies’ portfolios were active in China. However, two decades later, this has crossed the 60% mark. This shows that service providers are aware of the trends in the market and investing heavily in research and development to create new and innovative solutions to meet the growing energy demand.

Figure 1: Steadily growing share of electrical energy generation portfolios active in China

Get even deeper insight on the Future of Engineering

Looking to gain deeper insights into China’s expanding influence within the Engineering industry? Download our comprehensive “Future of Engineering” report to uncover key trends and discover how global players are responding to China’s growing dominance.

Who is developing the better quality portfolio: Chinese or international companies?

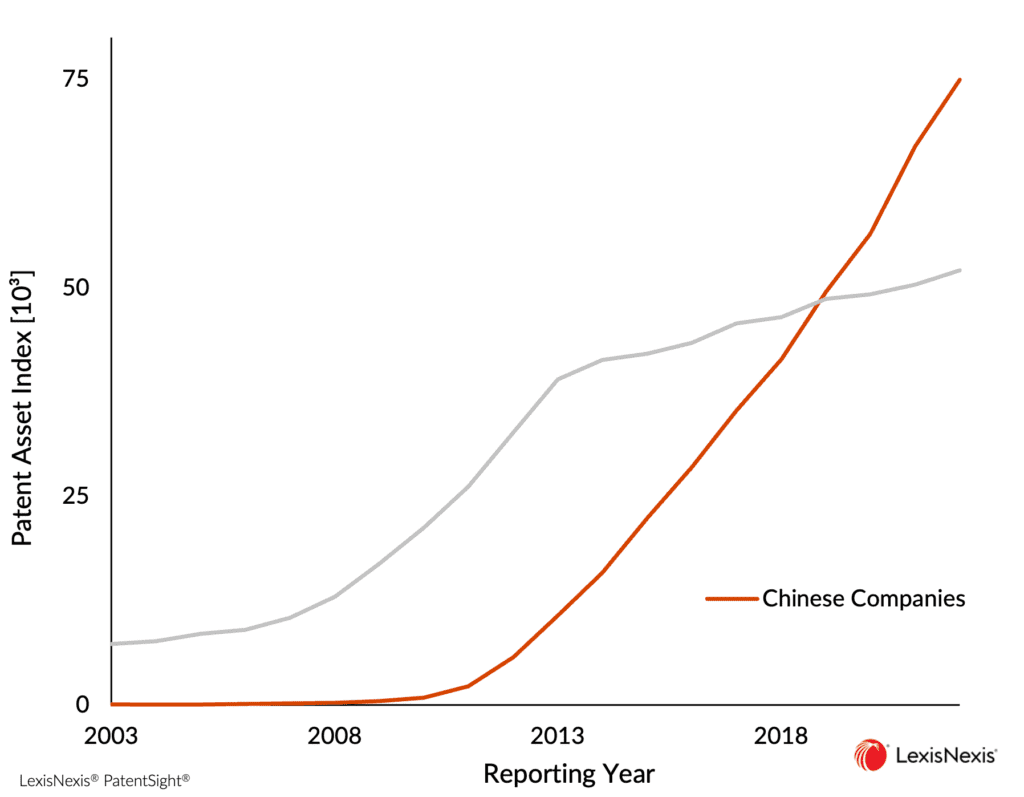

While the number of electrical energy generation patents from Engineering companies active in China shows us that there is increased patenting activity, it doesn’t help us fully understand the competitive landscape. To get a better understanding of the industry and its key players, we analyzed the strength of their patent portfolios using LexisNexis® PatentSight® patent analytics solution. PatentSight® leverages a unique, proprietary and scientifically validated patent valuation method called the Patent Asset Index. Analytics based on reliable patent data can provide some much-needed guidance and clarity to business decision making, especially in situations characterized by a dearth of public information, such as understanding the R&D strategies of Chinese companies.

Comparing the patent portfolios of selected Chinese and International Engineering companies with this qualitative measure, Figure 2 below shows that there has been a significant change in portfolio quality over the last 20 years. While international Engineering companies active in the energy industry have steadily increased the strength of their electrical energy-related patents between 2009 and 2013, their Chinese counterparts owned weaker portfolios until the early 2010s which only started to improve in terms of overall strength of portfolio in 2011. Since then, the strength of Chinese companies’ portfolios has continued to increase, and in 2019, it surpassed international companies in portfolio strength.

Figure 2: Chinese Engineering companies outpace international peers in developing high-quality inventions in technologies related to electrical energy generation

This gain in portfolio strength is mostly driven by the significant increase in patents owned by Chinese companies. In comparison to international Engineering companies, Chinese companies increased their share from 9% in 2003, and 39% in 2012, to 72% in 2022. This shows that Chinese companies are rapidly developing their portfolio. In the interest of surviving a market that is evolving in its search for replacement of fossil fuels, it is high time that international energy companies take note of this rising super-power set to be the world’s largest energy consumer. At the least, global players need to ensure their technology is currently protected in what will be the world’s largest market.

Leveraging IP to make the most of a rapidly growing Chinese energy market

This upward trend in the quality of electrical energy generation patent portfolios owned by Chinese Engineering companies raises important questions about the future of innovation and IP protection in China. What strategies must international Engineering companies deploy to protect their inventions in China’s rapidly changing energy landscape? Are Chinese inventors developing their own technology or are they dependent on the inventions of the international players? Who will be the dominant players in the energy market in China in the next decade?

These are critical questions that need to be addressed in the context of China’s growing energy demand and its intended transition towards a carbon neutral economy. Understanding these developments in domestic technology can help international companies adjust strategies, adapt faster to the market’s needs and avoid losing out on a major opportunity to expand business.

Do not miss part two of this series, where we will answer all the questions posed above and delve deeper into the implications of China’s growing energy demand on innovation and IP protection. The next blog will also explore strategies Engineering companies can adopt to protect their IP rights in China’s evolving energy landscape.

Speak with our experts

Are you looking to take your business to the next level and gain a competitive edge in your industry? Speak with our expert patent analytics team to learn how to leverage the power of patent data to achieve your business objectives.

Our team can provide insights into market trends, competitive analysis, and identify potential risks and opportunities for your business through patent analytics. Fill out the form to schedule a consultation.