10 Charts That Will Change Your Perspective of Amazon’s Patent Growth

by Louis Columbus

- Since 2010 Amazon has grown its patent portfolio from less than 1,000 active patents in 2010 to nearly 10,000 in 2019, a ten-fold increase in less than a decade.

- Amazon heavily cites Microsoft, IBM, and Alphabet, with 39%, 32% and 28% of Amazon’s total Patent Asset Index.

- Amazon’s patent portfolio is dominated by Cloud Computing, with the majority of the patents contributing to AWS’ current and future services roadmap. AWS achieved 41% year-over-year revenue growth in the latest fiscal quarter, reaching $7.6B in revenue.

Patents are fascinating because they provide a glimpse into potential plans, and roadmaps tech companies are considering. Amazon has one of the most interesting patent portfolios today that encompass a wide spectrum of technologies, from aircraft technology, drones, cloud computing, to machine learning. Interested in learning more about Amazon’s unique patent portfolio, I contacted LexisNexis® PatentSight®, one of the leading providers of patent analytics and provider of the PatentSight® analytics platform used for creating the ten charts shown below.

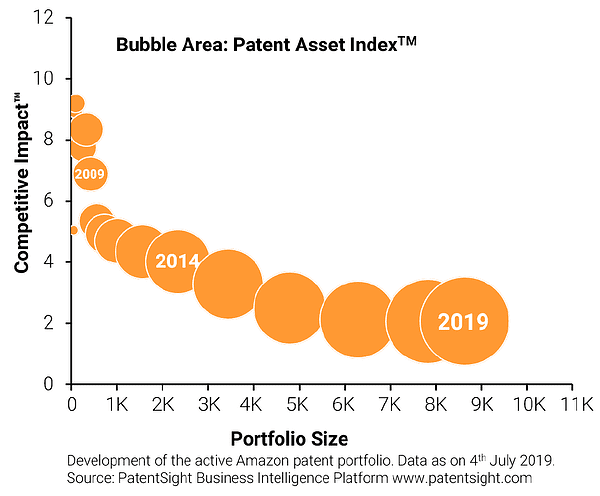

1. Amazon patents grew at a Compound Annual Growth Rate (CAGR) of above 35% between 2010 and 2019.

PatentSight analysis shows that Amazon’s patent portfolio has increased tenfold in the last decade, and is comprised entirely of organic patents with only a small percentage gained from acquisitions. PatentSight also finds that Amazon’s patents have a falling average quality as measured by their Competitive Impact score shown on the vertical axis of the chart below. As Amazon’s patent portfolio has grown, there has been a downward trend of quality. William Mansfield, Head of Consulting and Customer Success at PatentSight explains why. “To maintain a high quality when growing the portfolio is difficult, as each patent would need to be equally as good as or better than the previous,” he said. Mr. Mansfield’s analysis found that Amazon’s portfolio has an average Competitive Impact of 2 today, double the PatentSight database average of 1.

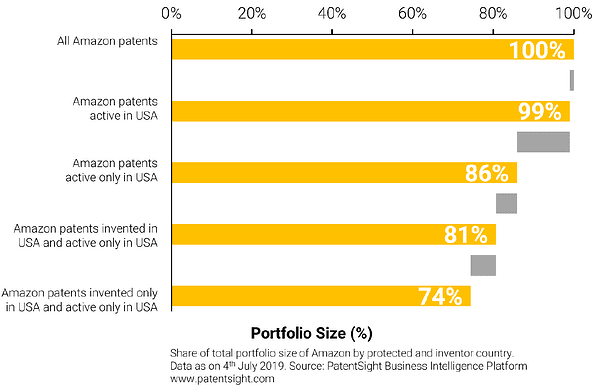

2. Amazon’s patent portfolio is unique in that 100% of it is protected in the U.S.

“The protection strategy of Amazon is also uncommon. While it can be the case that US firms tend to be US-centric, Amazon is an extreme case,” said William Mansfield. It’s surprising how many Amazon patents are active only in the USA (86%) and invented in the USA and active only in the USA (81%). William explained that “one factor for this US-centricity could be the great acceptance of software patents in the USA, we do also see high US-only filing for other tech giants, but are a level of around 60% vs. Amazon’s 86%.”

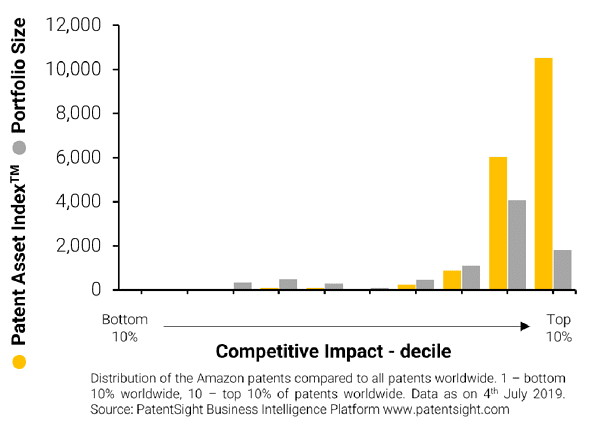

3. PatentSight found that the majority of the Amazon portfolio falls in the 2nd decile of Competitive Impact (top 20% – 10%).

Comparable technology-based organizations have a higher density of patents in the top 10% of Competitive Impact, which is another unusual aspect regarding Amazon’s patent growth. “This is unusual compared to other big tech companies which have more in the top 10%, it could be Amazon is holding onto more lower value assets than required,” William Mansfield remarked.

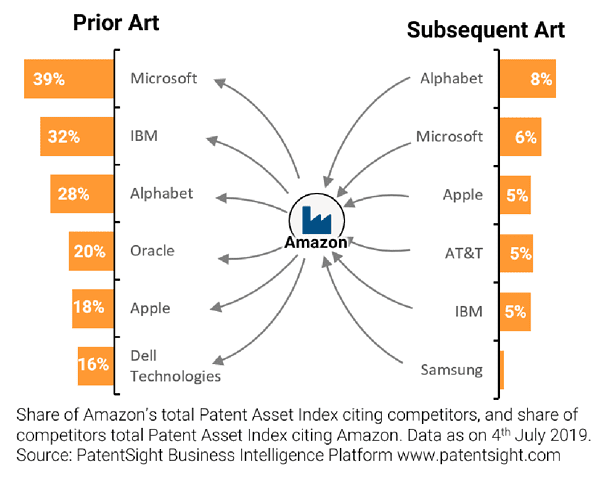

4. Amazon’s patent citations most often cite Microsoft, IBM, and Alphabet, with 39%, 32% and 28% of Amazon’s total Patent Asset Index.

Interesting that PatentSight’s analysis finds the reciprocal is not the case. A much smaller percentage of companies cite Amazon in return. This can be attributed to a few other firms having the breadth and depth of patent development that Amazon does today. PatentSight found that less than 10% of their respective portfolios even mention Amazon. William Mansfield explains that “one factor here is the larger size of these companies, vs. Amazon. However, even in absolute terms, Microsoft and IBM cite Amazon much less than the other way round. However, citation value is close to equal in absolute terms between Amazon and Alphabet.”

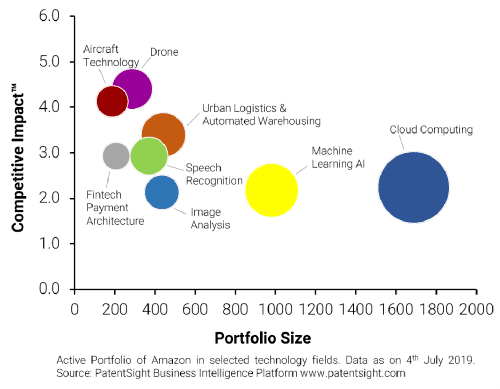

5. Relying on patents to keep AWS’ rapid growth going appears to be Amazon’s high priority patent strategy today.

As can be seen from the portfolio below, Cloud Computing patents dominate Amazon’s patent portfolio today. In the latest fiscal quarter ending March 31, 2019, AWS delivered $7.9B in revenue and$2.2B in operating income, growing 41% year-over-year. “Amazon’s ongoing developments in alternative delivery methods in Urban Logistics and Drones are noteworthy with Drones being one area of particular strength in the portfolio as seen from the high Competitive Impact, despite the smaller portfolio size,” notes William Mansfield.

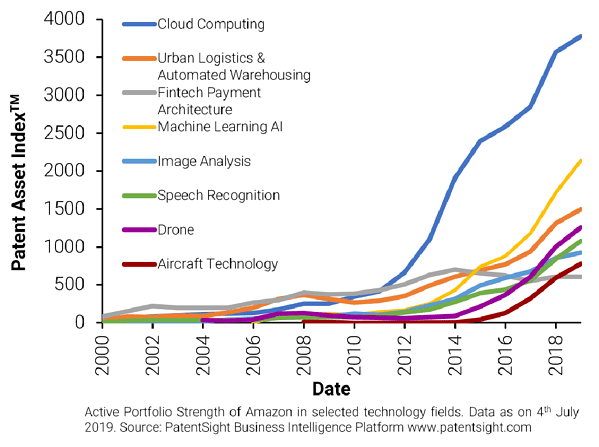

6. Amazon’s prioritization of cloud computing, AI, and machine learning patents is evident when 18 years of patent history is compared.

The proliferation of AI and machine learning-based services on the AWS platform is apparent in the trend line starting in 2014. The success of Amazon’s SageMaker machine learning platform is a case in point. Amazon SageMaker enables developers and data scientists to quickly and easily build, train, and deploy machine learning models at scale.

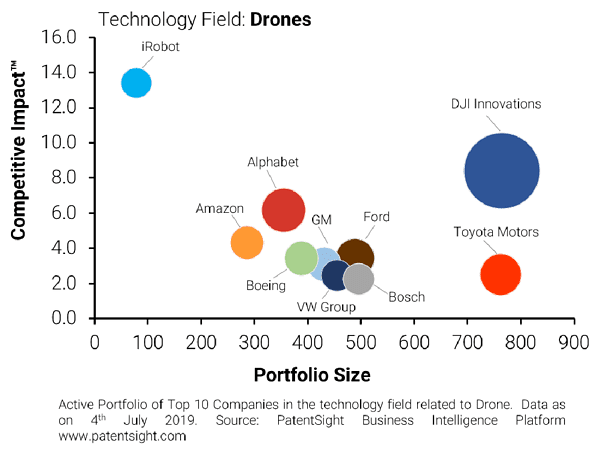

7. Amazon is already one of the top 10 patent holders in Drone technology, just behind Alphabet and Toyota Motors.

PatentSight defines Drone technology as encompassing aviation, autonomous robots, and autonomous driving. Amazon’s rapid ascent in this area is attributable to the logistics and supply chain efficiencies possible when Drones and their related technologies are applied to their supply chain’s more complex challenges.

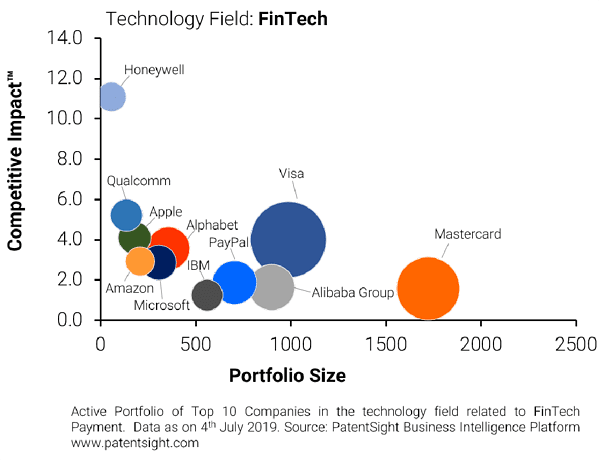

8. PatentSight finds that FinTech is an area of long-standing strength in the Amazon patent portfolio, attribute to their payment systems being the backbone of their e-commerce business.

Reflecting how diverse their business model has become, Amazon is now one of the top 15 patent holders in this area due to cloud computing, AI, and machine learning taking precedence. “FinTech is a highly competitive field with many established players, and while Amazon is not in the top 10, but top 15 players, it’s still an impressive achievement,” said William Mansfield.

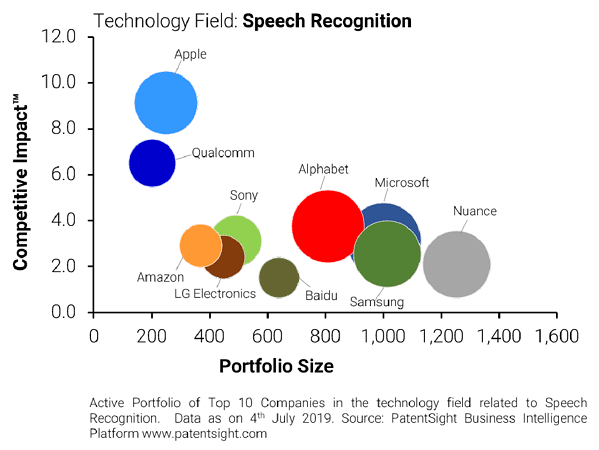

9. Amazon’s patent portfolio in speech recognition encompasses Alexa, its related patents, and Amazon Lex, an AWS service used for creating conversational interfaces for applications.

Alphabet, Apple, Microsoft, and Samsung are patent leaders, according to PatentSight analysis. The fact that Amazon is in the top 10 speaks to the level of activity and patent production going on in the Alexa research and development and product teams.

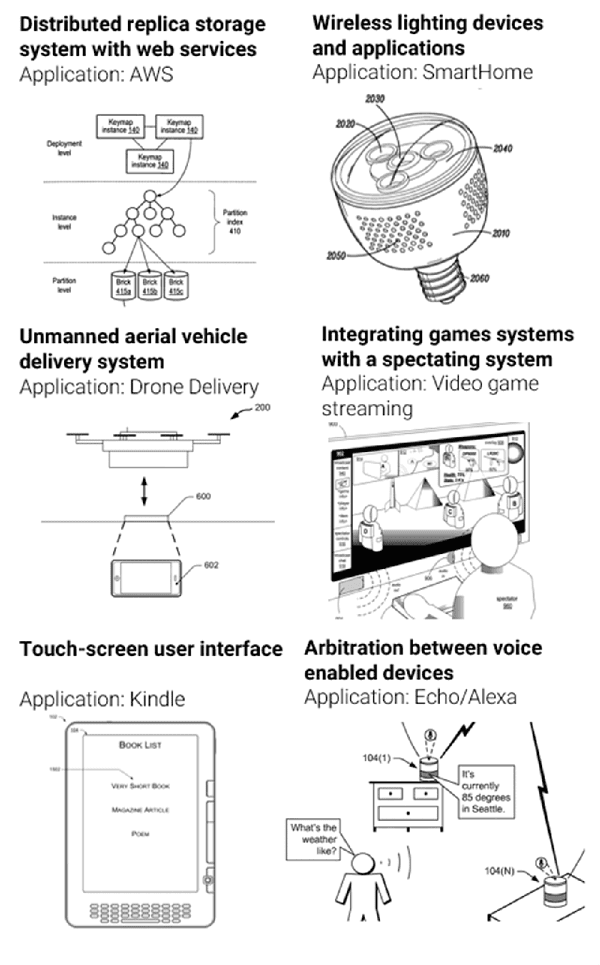

10. Amazon’s patent strategy is eclectic yet always anchored to cloud computing to make AWS the platform of choice.

The following selected patens reflect how broad the Amazon patent portfolio is. What each share in common is a reliance on AWS as the platform to ensure service consistency, reliability, and scale. An example of this is their patents Video Game Streaming.

Learn more about PatentSight and the Patent Asset Index.

Excellent data quality is the foundation of reliable analyses. Learn how PatentSight enhances patent data here.

About the author: Louis Columbus

Louis is currently serving as Principal, IQMS, part of Dassault Systèmes. Previous positions include product management at Ingram Cloud, product marketing at iBASEt, Plex Systems, senior analyst at AMR Research (now Gartner), marketing and business development at Cincom Systems, Ingram Micro, a SaaS start-up and at hardware companies. He is also a member of the Enterprise Irregulars. His background includes marketing, product management, sales and industry analyst roles in the enterprise software and IT industries. His academic background includes an MBA from Pepperdine University and completion of the Strategic Marketing Management and Digital Marketing Programs at the Stanford University Graduate School of Business. He teaches MBA courses in international business, global competitive strategies, international market research, and capstone courses in strategic planning and market research. He has taught at California State University, Fullerton: University of California, Irvine; Marymount University, and Webster University.

Follow Louis on Twitter or LinkedIn. Check out his website.