What Can We Learn From the Top 100 Innovators?

Check out the 2023 version of the Innovation Momentum report, available now!

A few weeks ago, we led a webinar based on our inaugural Innovation Momentum report, which considered about 11 million active patent families to determine the global top 100 innovators. This webinar featured speakers from three companies: Ofinno, Medtronic and 4Catalyzer. These companies all made it to the Top 100 innovators list, and the representatives spoke about the specific strategies and processes that placed them on this coveted list.

Here we summarize many key takeaways with discussions ranging from filing strategies to a companywide approach to innovation and other informative discourse during our webinar.

Why did we publish a top 100 innovators ranking?

Our aim when working on this report was to uncover forward-thinking patent development and spotlight true technological contemporaries across industries. We wanted to recognize technology owners who outperform their peers in continuous innovation. The result is a more inclusive list of innovators, capturing not only mature multinational innovators with billions of dollars in R&D expenses but also small startups developing early disruptive innovation.

One of the biggest differentiators between the Innovation Momentum and other existing industry reports is the transparency that the Patent Asset Index methodology brings to the discussion. Most other reports describe a vague approach to judging innovation or rely on the quantity of patents to make their findings; Innovation Momentum leverages a mathematical formula that anyone can use to recreate the same results we published. The transparency and reproducibility of the methodology behind the findings in our report make it a reliable source of information for practitioners.

What do these companies do?

It is a great privilege to gain insights into the inner workings of the forward-thinking companies featured in our Innovation Momentum Report ranking.

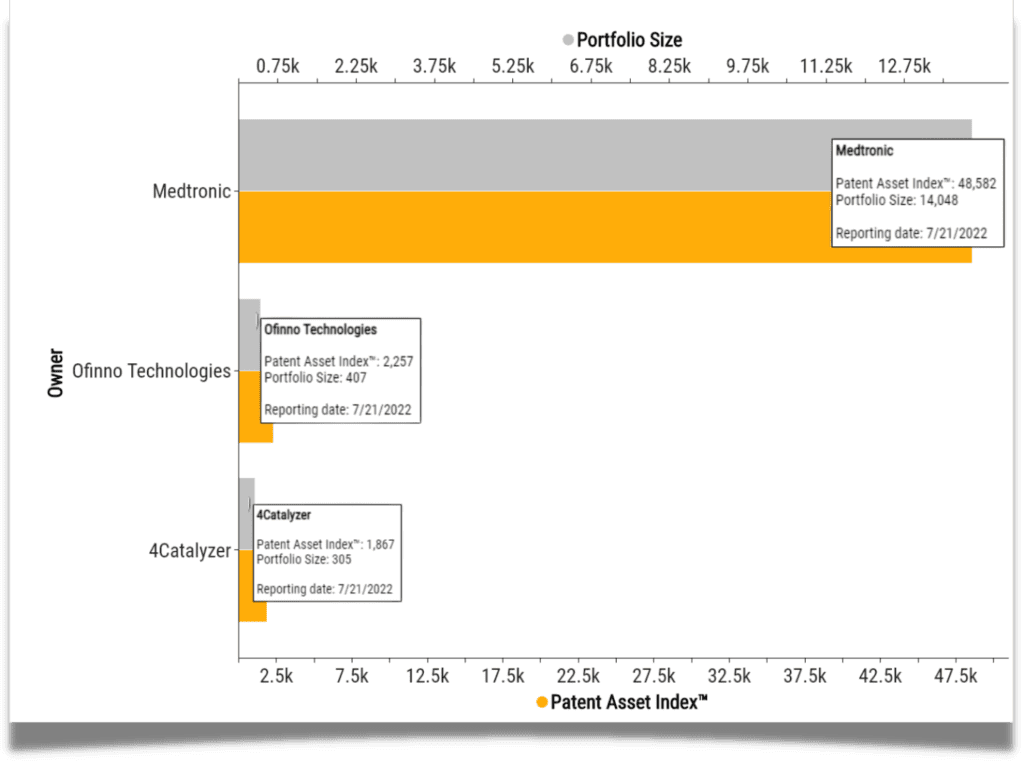

Medtronic is a global leader in medical technology, services, and solutions. With 14,048 active patent families, they own a relatively extensive patent portfolio. Most of their patents are filed in the USA, with Germany, China, and France coming in close behind.

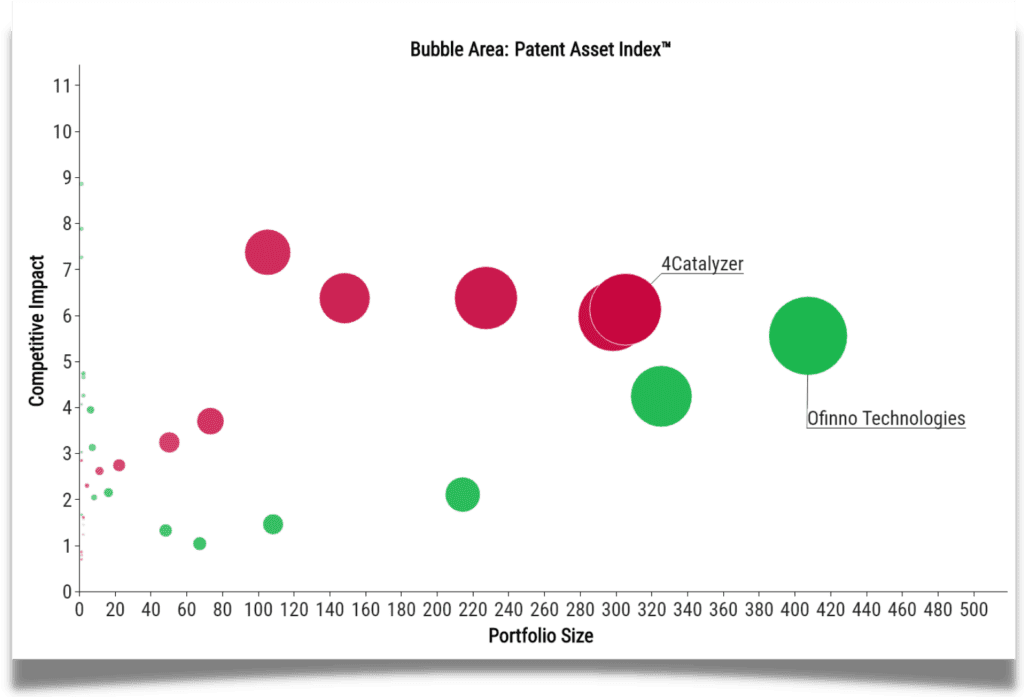

Ofinno is a research and development lab specializing in inventing and patenting future technologies. They own a smaller portfolio with 407 active patent families, mostly filed at the USPTO and the World Intellectual Property Office.

4Catalyzer acts primarily as an incubator for startups focusing on technologies across life science research tools, medical devices and therapeutics. With 301 active patent families, they maintain a smaller portfolio than the other companies on our list of top innovators.

General approaches toward innovation

Although these companies were all part of the same Top 100 innovators list, the three companies differ in their approaches to innovation management. As explained by their Senior IP Counsel, in the case of Ofinno, the strategy is a combination of people, environment and processes. On the other hand, Medtronic derives its IP strategy from their larger corporate strategy while ensuring that each year’s IP budget matches the current R&D expenditure.

In the case of 4Catalyzer, their founder is very IP savvy as a prolific inventor, holding over 800 patents. Since the company is in its nascent stages, it also devised its IP strategy to ensure all its IP is protected.

The strategies that put these companies on the top 100 innovators list

Medtronic

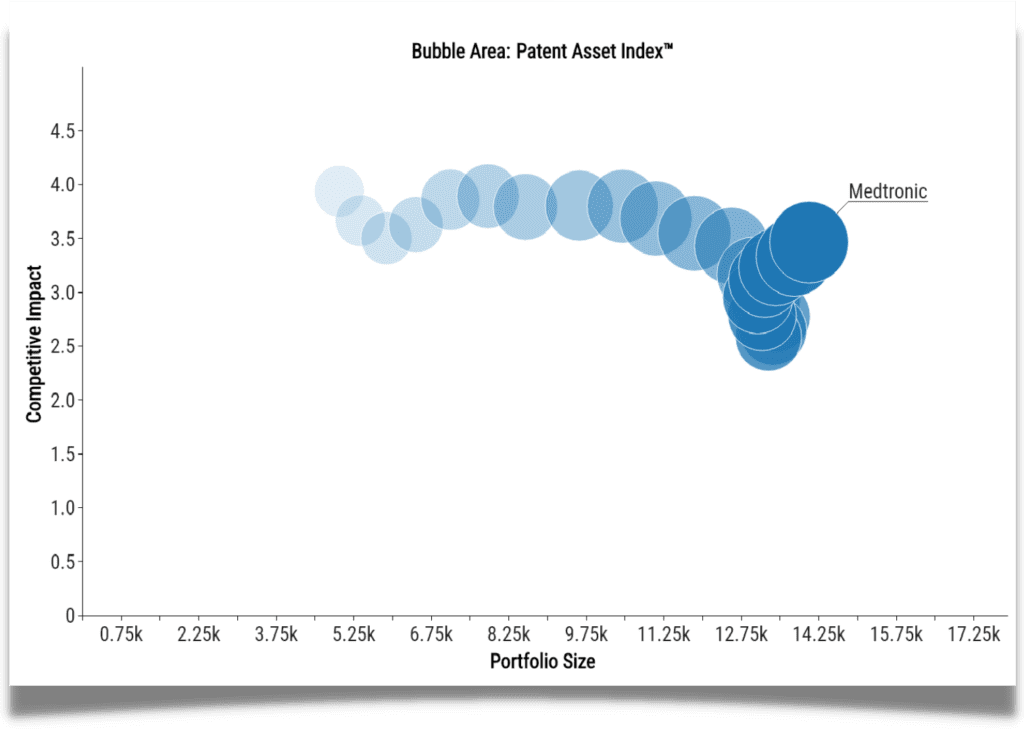

In the last years, as seen from the chart, their portfolio size and overall quality increased steadily, as indicated by Patent Asset Index. According to Mark Campagna, Senior Director of Patent Portfolio Strategy at Medtronic, they focused on pruning their portfolio while at the same time reinvesting cost savings into R&D and innovation. They also focused on improving their in-house patent processing strategy by using data to review risk areas and identify solutions. Overall, he said their company tries to foster a culture of innovation, which has impacted their results.

Ofinno

Founded by a researcher, Ofinno’s strategy ensures that all patents get drafted in-house. By reinvesting profits into hiring more research-focused personnel like PhDs and providing no disconnect between patent prosecutors and researchers, they ensure that the patenting process integrates into the innovation process. They begin developing filing strategies right alongside the technical research. While most companies keep their R&D teams separate from their patenting teams, virtually making it impossible for an inventor to be involved in the patenting process, at Ofinno, inventors work with the prosecutors, for example, in working through claims issues or assist in the drafting process, etc.

4Catalyzer

Since its founder is a serial inventor, 4Catalyzer already has a firm IP focus built into its overall strategy. Unlike traditional companies, 4Catalyzer works on developing technologies that can themselves be the cornerstone for a new company which is then spun off and handed off to an externally hired leadership team to run. During the initial phases of technological development, the in-house counsel fully supports the research team to ensure that the invention is patent-ready before it gets handed over to outside counsel for further prosecution.

Bringing IP into strategic C-suite discussions using analytics

All three of our guests on the webinar confirmed that getting facetime with their respective senior leadership teams can be very challenging since it’s not always easy for them to understand the complications of patents and the patenting process. On the other hand, they all agree that approaching leadership teams with data and data-driven insights such as those offered by LexisNexis® PatentSight® has proven to be very advantageous since it’s easier for the C-suite to digest information in the form of charts and stats. Once they understand the IP team’s challenges and how they have overcome them, it becomes easier to get more buy-in from the leadership teams.

If your IP team still uses traditional approaches to get C-suite buy-in, we recommend you find out more about our solutions to benefit you in achieving your goals.

Watch the entire webinar here to listen to the full discussion around IP strategies that earned these companies a spot on our Top 100 Innovators list.

Get actionable insights for strategic decision making

Want to become more effective at managing your patent portfolio, identify worldwide relevant patents and technology trends, assess the competitive landscape, and find partners and licensing opportunities?