Determining Patent Valuation With Patent Prosecution Analytics

Why patent valuation?

There are many reasons to assess intellectual property or a patent application’s value. Before investing, venture capitalists may wish to value the company’s patent portfolio to help determine the company’s value and the risk of the investment. For small companies, a valuable patent could be their ticket to needed funding. Companies who want to sell their patents, or who go through mergers and acquisitions, need to know the value of their patents so they can sell at an equitable price. On a more personal level, applicants with pending patent applications can weigh their patent application’s potential value against the cost of patent prosecution decisions to help develop an efficient patent prosecution strategy.

What affects patent valuation?

The most common patent value indicators are not available until long after a patent has been issued. A patent’s litigation history, for example, can provide key insights into the scope and strength of a granted patent, but it is only useful in circumstances where litigation has actually occurred.

A patent’s value can be decided through various techniques. Methods of patent valuation are usually organized into three integral approaches: the “market approach,” the “cost approach,” and the “income approach.” Each approach has a unique perspective of value, so depending on the patent, one specific approach may be more relevant than another.

Market approach: When determining the value of an asset, the market approach strongly takes into consideration the price that was paid for the asset or comparable assets that were purchased around the valuation date. Similar patents can be evaluated to find general market value and what is a fair price for the current offering. This approach works best for tangible assets.

Cost approach: The cost approach generally considers a ‘replacement cost’ by analyzing out-of-pocket expenses, lost sales, risks, and other economic outcomes associated with alternative technology. The cost approach focuses on ensuring that the investor will not pay any more for an asset than what it would cost to create or purchase a new asset of equal utility. Comparing that state of competitor patents can also affect cost approach as a crowded patent category offers less value.

Income approach: The income approach tends to be the most used and reliable valuation method. This approach determines asset value based on the future income flows the asset is expected to achieve. The more the patent is tied directly to revenue, allows for premium pricing, or drives the sale of related products, the higher the income valuation will be. Income valuation can also be affected by the industry or nicheness of the patent. If the use-cases for the patent are few and the sales far in between, there will be less income resulting from the patent and therefore a lower income valuation.

Evaluating the value of pending patent applications can be much more difficult because there is less information to draw upon. Due to the complexity of valuing patent applications and patent portfolios composed of patent applications, any hint at a patent’s value can be informative. As a result, more patent practitioners are turning to patent analytics to uncover key insights that can be used to help determine the value of early-stage patent documents.

Patent application value indicators

Valuing a patent application is particularly difficult because, in addition to determining the potential strength and market value of the patent application, the overall cost and likelihood of the patent being granted should also be taken into account. Fortunately, the LexisNexis PatentAdvisor® patent prosecution platform has several tools to help predict outcomes and value patent applications at various stages of the patent process.

Tech Center Navigator (formerly Pathways™) – The Tech Center Navigator, available on the PatentAdvisor™ patent analytics platform, can help patent applicants assess the difficulty of future prosecution based on the content of a patent application even before it is filed. The Tech Center Navigator uses keywords to predict which USPTO art units are most likely to evaluate a patent application. It also provides patent statistics about those likely art units and can indicate how difficult and expensive patent prosecution will be. With this information, patent applicants can gain a sense for their odds against the USPTO, and can adjust their valuation of the patent application accordingly.

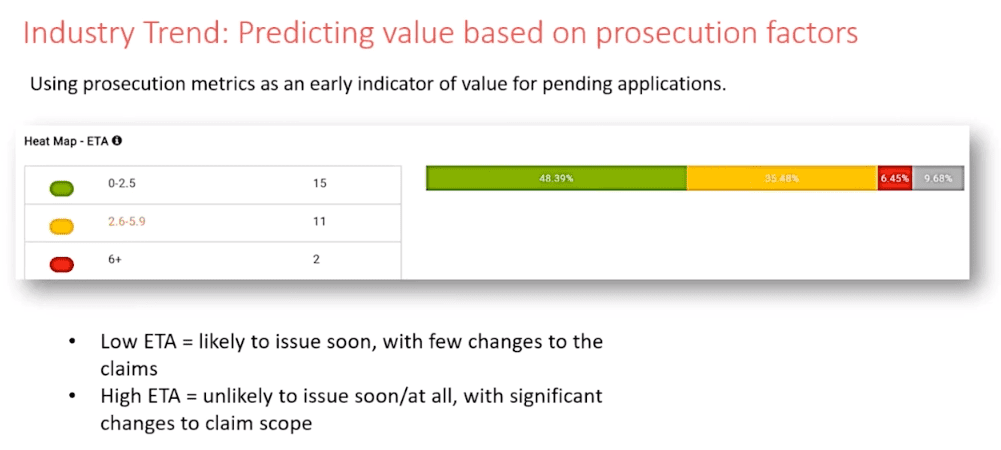

PatentAdvisor ETA™ – After filing, and once a patent examiner has been assigned, PatentAdvisor provides users with the most predictive patent metric available. The system calculates a PatentAdvisor ETA value for each USPTO patent examiner. Based on several patent statistics, the PatentAdvisor ETA can be used to predict how patent prosecution will play out. For example, patent examiners with low ETA values are statistically very likely to issue patents quickly and with few changes to a patent application’s claims. Patent examiners with high ETA values, on the other hand, have a low likelihood of granting a patent and, if a patent is granted, then it will most likely be granted after significant changes. Because low-ETA patent applications are much more likely to have favorable prosecution outcomes, they often have greater perceived value than patent applications assigned to patent examiners with high ETA values.

PatentAdvisor Patent Statistics

As patent prosecution progresses, patent applicants are often faced with many strategic decisions. The PatentAdvisor platform provides several patent statistics that can be used to more effectively navigate the patent process. For example, should an applicant need to decide between filing an RCE or an appeal, PatentAdvisor can show users how other patent applicants fared against their patent examiner in similar situations. Patent applicants can use this information to choose the path that is most likely to result in a granted patent, and can assess the patent application’s value based on its likelihood of being issued.

LexisNexis® Intellectual Property offers patent prosecution solutions to help assign value to patent applications in all stages of the patent process.

PatentAdvisor provides exclusive patent analysis tools for successful patent prosecution. Learn more by reading Patent Prosecution Analytics: No Longer Just a Nice to Have and watching the on-demand webinar.

Visualize your examiner performance and tailor your prosecution strategy with PatentAdvisor ETA.

Gain insight into your application’s future to help you develop data-driven filing strategies with LexisNexis Tech Center Navigator.

Need more predictability in the patent prosecution process?

Learn how to develop successful IP strategies and proficiently manage patent applications throughout the entire prosecution process using data-driven insights and advanced analytics.